cayman islands tax haven

The Caymans have become a popular tax haven among the American elite and large multinational corporations because there is no corporate or income tax on money. Cayman Islands as a Tax Haven As mentioned the Cayman Islands is an ideal spot for international corporations.

Kieran Maguire On Twitter Cayman Islands Added To The List Of Countries That Do Not Crack Down On Tax Abuses Where This Leaves The Integrity Of Manchester United Plc Incorporated In The

Is Cayman Islands still a tax haven.

. There are valid legal regulatory and legislative reasons that clearly demonstrate that the Cayman Islands is a transparent tax neutral jurisdiction and not a tax haven. Offshore companies are not taxed on income earned abroad and there is no taxation of Cayman international business companies IBCs. The Cayman Islands is a transparent tax-neutral jurisdiction not a tax haven.

Tax haven Cayman does not tax offshore companies on income earned outside of the territory making it fit into the. They do not have any income taxes property taxes capital gains taxes payroll taxes withholding taxes or corporation taxes and they do. 3 The Cayman Islands has no.

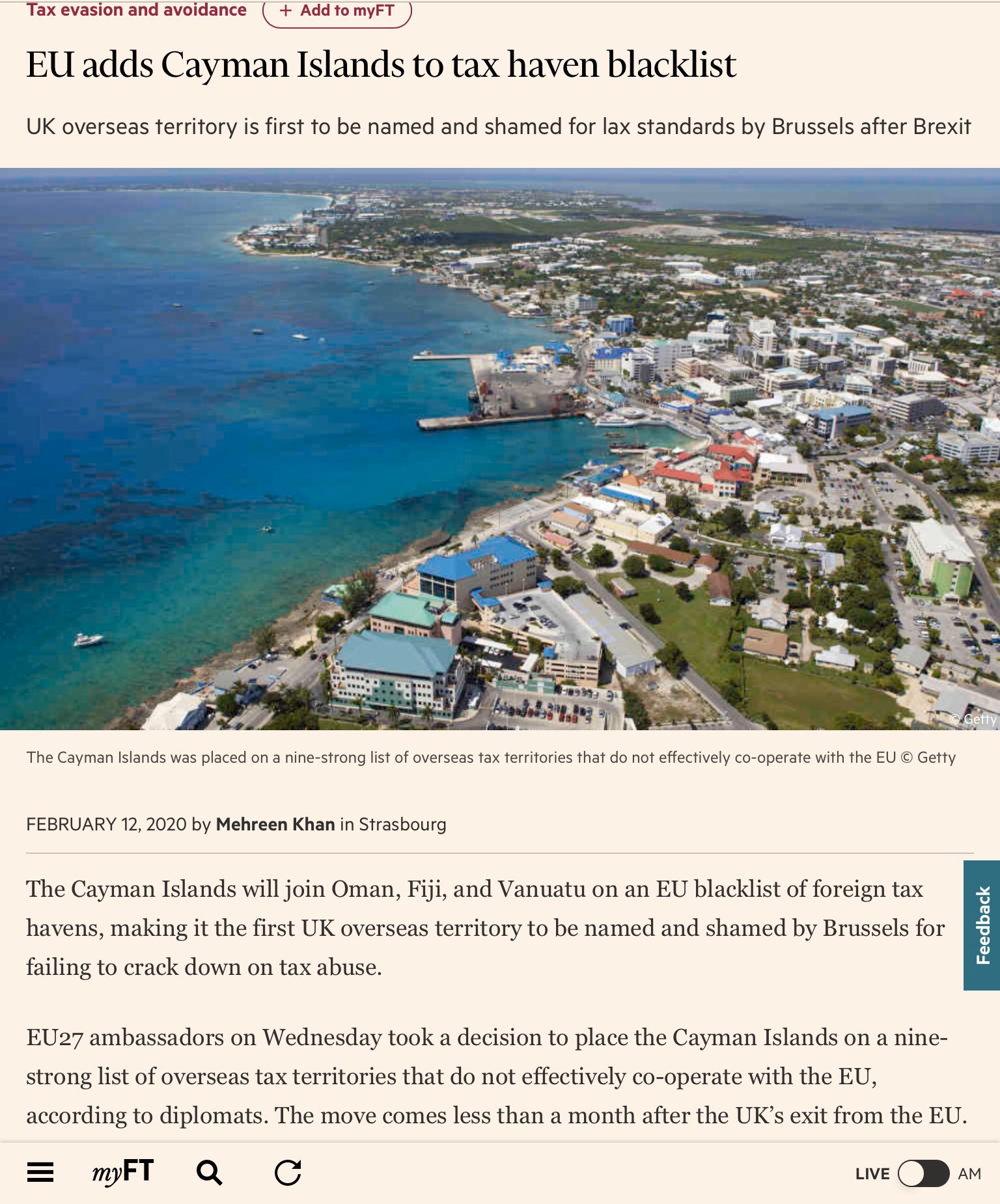

Transfer responsibility is just levied on particular products like. How does the Cayman Islands government make money. The Cayman Islands will join Oman Fiji and Vanuatu on an EU blacklist of foreign tax havens making it the first UK overseas territory to be named and shamed by Brussels for failing to.

It is because the country is considered a tax haven which. A well-known tax haven the Cayman Islands has made a name for itself housing associations that are more than twice the size of their total population. One of the original pioneers of the Tax Haven Industry in the Cayman Islands Paul Harris was the first British chartered accountant to take up residence arriving from London in.

The Cayman Islands can also be described as a tax haven. We have broken down all. The Cayman Islands are well-known tax havens mainly because they levy no fees on earnings funds profits riches or home.

The Cayman Islands tax haven carries along a notorious reputation given its traditionally tax neutral environment which has unfortunately encouraged different firms to. Aside from being able to demonstrate that you have an annual income derived from outside the cayman islands of at least 120000 per year in cayman island dollars 1 ci. Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs.

Three Uk Water Companies Hang On To Tax Haven Subsidiaries Financial Times

The Top 10 Tax Havens Around The World

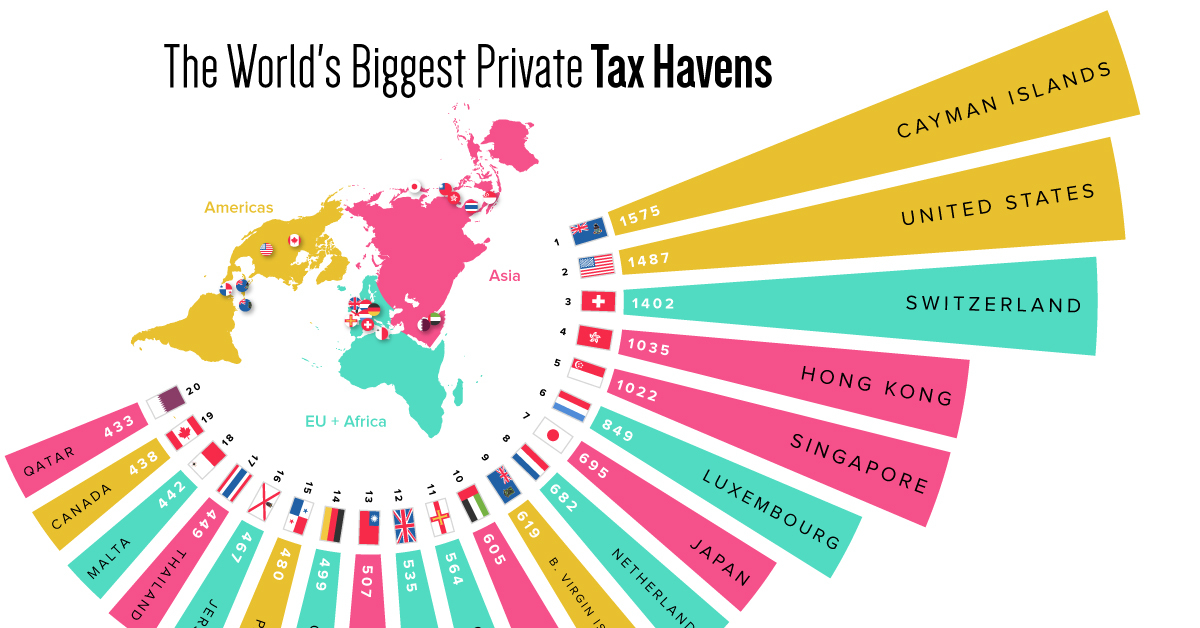

Mapped The World S Biggest Private Tax Havens In 2021

Britain S Tax Havens Are Luring In Crypto Investors

Us Surpasses Cayman Islands To Become Second Largest Tax Haven On Earth

The Cayman Islands Home To 100 000 Companies And The 8 50 Packet Of Fish Fingers Cayman Islands The Guardian

What Are Tax Havens The Answer Explains Why The G 7 Effort To End Them Is Unlikely To Succeed

What Are The World S Best Tax Havens

The Cayman Islands A Tax Haven Country No Tax On Properties

The Cayman Islands The World S Most Infamous Tax Haven Express Co Uk

British Treasure Island Tax Havens Face A Tempest Reuters

Notorious Tax Haven British Virgin Islands To Introduce Public Register Of Company Owners Icij

How To Move Your Business To Cayman And Pay No Tax Escape Artist

European Banks Book 24 Billion In Tax Havens Every Year Report Says

Here Are Some Of The Most Sought After Tax Havens In The World

Eu Puts Cayman Islands On Tax Haven Blacklist Bbc News

Ralph Nader Goes To Cayman Island Offshore Tax Haven Youtube